FAIT, not Dead, but Wounded

***This is a repost from a June 18th Cheap Convexity post. To receive Cheap Convexity twice a week in your inbox subscribe here.

The only way to really start with the Fed is with the dots. There seem to be two things that are true, this meeting was a communication disaster, but it also does not change the structure of the framework that still allows for extremely low interest rates in an extremely strong economy.

The 2023 interest rate dot is crucial: It is the market’s litmus test for FAIT (flexible average inflation targeting). You say you want to delink the growth outlook from policy in a way that allows the economy the pro-cyclically expand the stance of policy, ok, show me in the dots. That was kind of busted on Wednesday. And while it is likely that the 5 dots that stayed at zero were the board’s and not regional bank guys, this change in the dots changes the calculus for the market doing the pro-cyclical trade, at least in the short term.

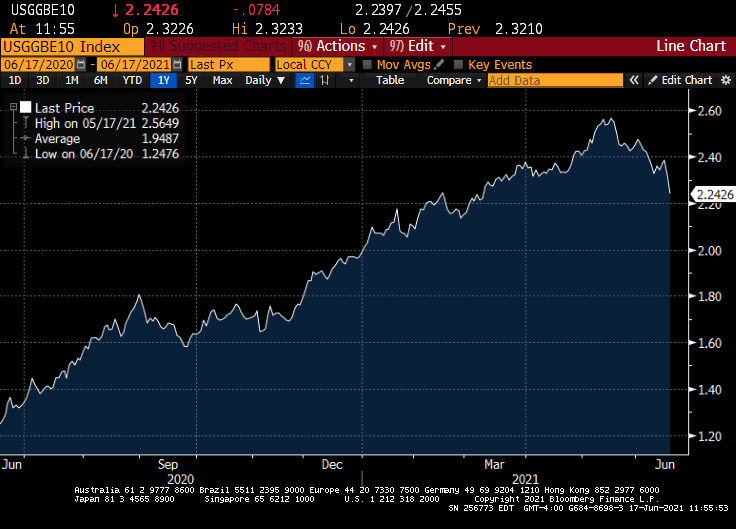

10y breakevens

The moves in the dots set a fairly hawkish precedent, especially relative the March meeting.

1) First, the dots really contradicted the Fed’s idea of inflation being transitory, and that was echoed by a lack of that language in press conference. If inflation is transitory, even at high level like 3% PCE this year, then why is the Fed changing its tune when the employment side doesn’t look that much different than it did in March? I.e. the Fed really undermined the transitory narrative.

2) Second, the bar has now been set for the dots to move again and it is asymmetric. If nothing outside of the PCE forecast in 2021 moved the ‘23 rate dots, what happens when 2022 growth is revised higher?

3) Third, the Fed effectively told us what a modest overshoot of inflation is, and it’s not 2.5% what many (including myself) thought it was. The bar to hike rates in the new framework is max employment and inflation modestly on track to exceed 2% for some time, 2.2% and 2.1% is sort of home, according the dots. I.e. on a rate of change basis, “modest” went from maybe 2.3-2.5 to 2.1-2.2, which effectively means that “meaningful” is now 2.5 and above. That’s not where the market was before this meeting.

The other fairly hawkish takeaway was actually from the presser on the labor market. Powell basically told us that “substantial further progress” is fait accompli and his point on labor force participation was noteworthy. Of course, the Fed may just adjust to a prime age EPOP type reading as their compass, but in a meeting where the theme was the bar to tightening was maybe a tad lower than we previously thought, this was just fuel to the fire.

And finally, to complete the hawkish trifecta, the statement’s language on transitory was unchanged. The April minutes suggested that we may get some expansion of transitory in terms of duration.

“Looking further ahead, participants expected inflation to be at levels consistent with achieving the Committee’s objectives over time. A number of participants remarked that supply chain bottlenecks and input shortages may not be resolved quickly and, if so, these factors could put upward pressure on prices beyond this year.”

The language on transitory was unchanged. This of course could still come, but given the context of the dots, it is certainly looking like the confidence in transitory got relatively shakier.

Overall: The Fed was not a hawkish in a way that will prove to be a policy mistake, but they were hawkish in a way that reduces the right tail for growth/inflation and the market will have to adjust to that.

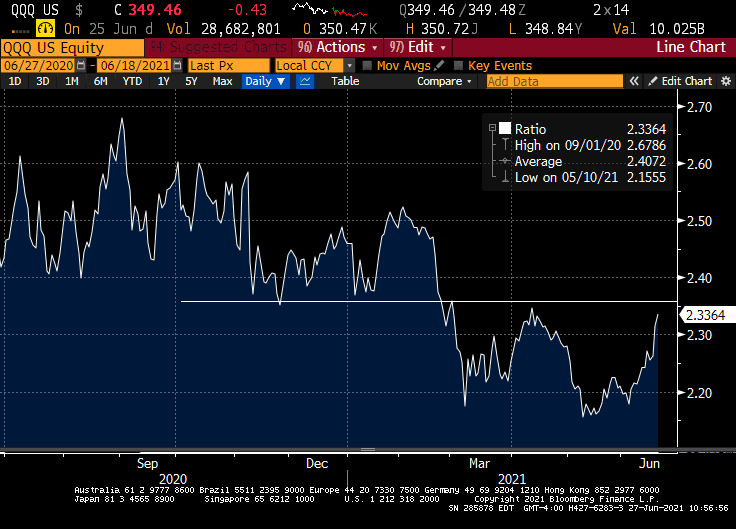

Tech v Russell Equal Weight